His expensive tax cuts have been signed into law. His steep global tariffs are taking clearer shape. And his twin campaigns to deregulate government and deport immigrants are well underway.

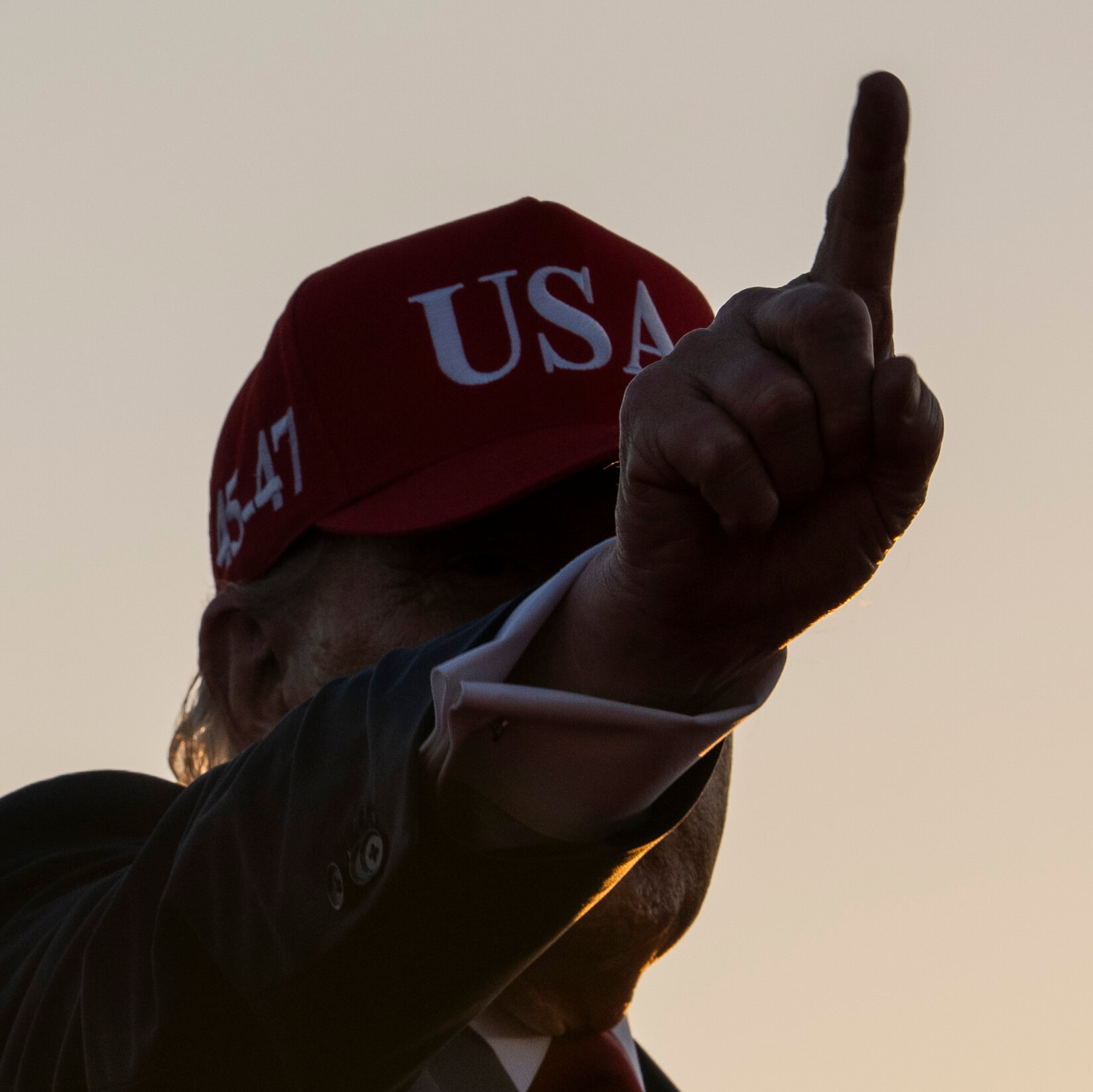

With the major components of his agenda now coming into focus, President Trump has already left an indelible mark on the U.S. economy. The triumphs and turbulence that may soon arise will squarely belong to him.

Not even six months into his second term, Mr. Trump has forged ahead with the grand and potentially disruptive economic experiment that he first previewed during the 2024 campaign. His actions in recent weeks have staked the future of the nation’s finances — and its centuries-old trading relationships — on a belief that many economists’ most dire warnings are wrong.

Last week, the president enacted a sprawling set of tax cuts that he believes to be the ingredients for rapid economic growth, even as fiscal experts warned that the law may injure the poor while putting the U.S. government on a risky new fiscal path.

Then, on Monday, Mr. Trump began to issue his latest round of tariff threats, insisting that “we’re done” negotiating as economists warned about a potential surge in consumer prices that could arise from taxing imports.

The White House also proceeded with its aggressive and legally contested plans to eliminate scores of federal regulations and deport millions of migrants. The immigration crackdown, in particular, could come to the detriment of many sectors, like agriculture, that rely heavily on foreign labor, experts believe.

So far, the U.S. economy has remained resilient in the face of these seismic changes, while Mr. Trump has ascribed the faintest hint of negative news to his predecessor, former President Joseph R. Biden Jr.

“I think the good parts are the Trump economy and the bad parts are the Biden economy because he’s done a terrible job,” Mr. Trump told NBC’s “Meet the Press” in May.

But the president has now achieved broad swaths of what he set out to do, making him responsible for the highs or lows on the horizon. The coming months will serve as a gauge of whether he is merely enjoying a calm before a damaging storm — or is correct in asserting that his agenda is not as perilous as many economists have feared.

The White House did not respond to a request for comment.

For the moment, the U.S. economy appears strong, even as it shows some early signs of strain.

Last month, the United States added 147,000 jobs, beating analysts’ expectations. Yet the sources of that growth also appeared to narrow, evidenced in a continued slump in manufacturing jobs and lackluster hiring across the retail and professional services sectors. The unemployment rate ticked down to 4.1 percent, but the number of people out of work for more than six months rose.

While inflation remained relatively muted through May, consumer spending, which is the primary driver of U.S. economic growth, has started to sputter, as Americans pull back on purchases after months of stockpiling to get ahead of Mr. Trump’s tariffs.

David Kelly, the chief global strategist for J.P. Morgan Asset Management, still described the U.S. economy as a “relatively healthy tortoise,” resilient and expanding, slowly but surely. He projected that the nation’s gross domestic product, a measure of its total output, would grow about 1 percent by the end of 2025 compared with the year prior.

But, he added, the economy has reached a “bit of a diversion in the road,” as some of Mr. Trump’s new policies start to take effect.

At the heart of that agenda is an expensive new domestic policy law, which Mr. Trump signed into law on Friday. The package primarily preserves a set of low tax rates clinched during the president’s first term, while provisioning new, and in some cases generous, tax reductions for businesses, seniors and certain workers, including those who earn overtime.

Many Americans, particularly the wealthy, could see lower tax bills in the coming years, congressional analysts previously found. But Republicans financed that package with deep cuts to federal safety net programs, which could leave poorer Americans worse off under a law that’s still expected to add more than $3 trillion to the debt.

Maya MacGuineas, the president of the Committee for a Responsible Federal Budget, said the cost of the legislation would send the nation’s fiscal imbalance to a level not seen since after World War II. That would weigh down private investment and push up the costs of borrowing money, not only for the government but also for average Americans.

“This will slow economic growth,” predicted Ms. MacGuineas, whose group supports deficit reduction.

Mr. Trump and his top aides have swatted away those predictions. Last month, they estimated that the tax measure — and the rest of the president’s agenda — would generate enough revenue and economic activity to reduce deficits by as much as $11 trillion. Even conservative economists have said some of the administration’s predictions are overly rosy.

“The growth that’s just attributed to the tax cut is way too hot, even compared with what conservatives like me would say,” said Glenn Hubbard, who served as chair of the Council of Economic Advisers under President George W. Bush. “It’s just way, way, way out of line.”

Some of that revenue is expected to come from Mr. Trump’s tariffs, which he broadened this week. Targeting an initial batch of 14 countries, the president on Monday threatened duties as high as 40 percent unless those nations strike favorable trade deals with the United States.

A day later, Mr. Trump promised to unveil new duties on imported drugs, computer chips and coppers, as he promised that “the big money will start coming in on Aug. 1.” The president’s top advisers have said they expect to collect more than $300 billion from tariffs by the end of the year.

Mr. Trump’s trade brinkmanship dates back to April, when he announced and later suspended a vast set of eye-watering duties in the hopes of striking trade deals globally. Most economists warned during that 90-day pause that his tariffs, if carried out, would inflict severe economic harm, a set of alarms they renewed this week as the president doubled down on his approach.

“It’s inevitable that whatever is in place at the end of the day is going to get passed along; it’s just a matter of when,” said Douglas Holtz-Eakin, the president of the conservative American Action Forum.

On Monday, the Budget Lab at Yale, a nonpartisan research center, estimated that the president’s duties — including those to come next month — would cause households to lose $2,300 on average in income this year.

But the White House has long rejected similar projections and produced estimates of its own. It found on Tuesday that the price of imported goods had fallen faster than overall goods prices since February. Mr. Trump’s top aides said it showed that the president’s tariffs were not leading to “an acceleration of inflation,” though economists later questioned elements of the report.

“There’s no sustained pattern of a tariff-driven price pressure anywhere,” Stephen Miran, the chairman of the White House Council of Economic Advisers, said on CNBC.

The vast uncertainty, particularly around tariffs, has frozen the Federal Reserve, which has left borrowing costs untouched for months as it waits to see the fuller effects of Mr. Trump’s policies. That has provided the president with a convenient “fall guy” in Jerome H. Powell, the Fed chair, whom Mr. Trump has branded “Mr. Too Late” for not lowering borrowing costs as he has demanded.

“If you end up with things like tariffs pushing up inflation and pushing down growth in the short term, then it can almost suit you as president to blame bad economic data on an ‘incompetent’ Fed chair,” said Mark Dowding, the chief investment officer for fixed income at RBC BlueBay Asset Management.

-3.png)