For more than a decade, Rudi Hendri sold locally made clothes from a stall inside Jakarta’s labyrinthine Tanah Abang market. Then three years ago, a businessman from China and his translator showed up with a proposition and changed everything.

They brought samples of sportswear, made in Chinese factories, that were well made and cheaper than the Indonesian-made wares Mr. Rudi had always sold. Mr. Rudi, 55, felt he couldn’t say no. Now he runs three stalls and has a partnership with multiple Chinese factories.

“If the product quality is good and the price is right for me, I’ll take that,” Mr. Rudi said last week at Tanah Abang. Nearby, his workers sifted through a mountain of Chinese-made clothes.

When President Trump complains that trade with China is killing jobs, it resonates in Indonesia. But it is Indonesian jobs that cannot compete: The country has been dealing with China’s outsize influence on every aspect of its economy for more than a decade.

“The worst-case scenario is not that we can’t export,” said Redma Gita Wirawasta, the chairman of the Indonesian Fiber and Filament Yarn Producers Association, referring to Mr. Trump’s tariffs on Indonesian goods. “The worst-case scenario is that more and more Chinese goods will come to Indonesia.”

The garment industry has felt it acutely over the past two years, as China has inundated Indonesian consumers with its clothes and taken over local factories. Ruthless competition from cheap Chinese goods has wiped out local factories and mills. The entire domestic supply chain is being dismantled. By Mr. Redma’s estimate, 300,000 people have lost their jobs since 2023.

At another clothing stall near Mr. Rudi’s at Tanah Abang, Samuel Lie, 48, counts himself lucky if he can make $4,000 a month these days, less than half of what he used to make. Most of his clients stopped buying from him a few years ago. They tell him that it is cheaper to buy from China.

“We can’t compete on quality,” he said.

The pressure has become so severe that Indonesia’s last president threatened tariffs of up to 200 percent on Chinese goods. The current president, Prabowo Subianto, even called for the sinking of ships smuggling in textiles, the majority of them arriving from China.

The urgency has coincided with an acceleration of China’s exports as its economic growth slows. With consumption at home weak, Chinese factories, fueled by government loans and support, have turned to Southeast Asia because of its proximity and market potential. Indonesia alone has a population of 284 million. The pace of exports from China to Southeast Asia has only picked up since Mr. Trump’s latest tariffs on Chinese goods, which have effectively shut off China’s biggest market: the United States.

For months, China’s exports to Southeast Asia have surged — last month by 17.5 percent from a year earlier. Indonesia’s monthly imports of Chinese goods spiked 51 percent in April, the most recent data.

The surge in Chinese exports to the region has animated Mr. Trump’s ire that China is doing more to reroute its goods through other countries to avoid his new taxes on American importers. Indonesia and the United States agreed this week on a trade deal that places a 19 percent tariff on Indonesian goods in the United States, or an ever steeper levy if goods were found to be rerouted through Indonesia from a country with a higher tariff rate.

But economists said the phenomenon angering Mr. Trump, known as transshipment, is not as big a factor in Indonesia as it is in countries like Vietnam. Most of the Chinese goods going into Indonesia are being bought up by Indonesian consumers, said Euben Paracuelles, chief economist for the region at Nomura, the Japanese bank.

“This is not a case of goods being shipped to the U.S.,” he added.

The solution for Indonesia, as it is for many other countries in this part of the world, is not necessarily putting up trade barriers against China.

Indonesia has become dependent on China for investment to help build out its infrastructure. It’s also the biggest buyer of natural resources like palm oil and coal that drive the Indonesian economy.

But China’s ability to make cheap goods at enormous scale, aided by generous government subsidies to exporters, has meant that Indonesia is more often the loser when trading with China. Indonesia’s economy has become so intertwined with China’s that, by one estimate, when China’s economy slows by one percentage point, it causes a 0.3-percentage-point decrease in Indonesia’s own economic growth.

In the early 2000s, the regional trading bloc the Association of Southeast Asian Nations created a pact with China that required countries to lower their tariffs. Indonesia, which is a member, has lowered nearly all of its barriers to Chinese goods.

“This has been the main reason for why China sees ASEAN as a market where they can diversify their exports,” Mr. Paracuelles said.

China helped to build the high-speed train that starts in the heart of Jakarta and barrels east at 200 miles an hour along the verdant countryside to the city of Bandung, where warehouses and stalls have sold fabrics from nearby mills for decades. Known as the Whoosh, its upholstery and signage is identical to the high-speed trains that connect vast swaths of China.

In a nearby market on the outskirts of Bandung, salespeople hawk Chinese fabrics, which have largely replaced locally made ones, except for batik, traditional dyed fabric.

“We feel it, too, here,” said Erik Kurniawan, 25, who took a break from selling the fabrics in his stall on a TikTok livestream. He said that before 2021, the market was focused on selling leftover fabrics from nearby textile factories. Now it sells more fabrics imported from China.

Li Jialun, 73, recalled a time starting in the late 1970s when he was running factories in Bandung making jeans to export to the United States. He has retired from manufacturing — he owns a local Chinese restaurant, Ya Xiu — but said his friends had shut their factories because they could not compete with China.

The effect of those closures ripples through the local economy, costing jobs and hurting businesses that worked for them, said Mr. Li, who was born in Jakarta.

“Factories don’t stand alone; there are suppliers,” he said. “Those suppliers are far more numerous. So it affected many people. We can no longer compete with China.”

Three-quarters of his customers at the Ya Xiu restaurant are Chinese, he said. During the Covid-19 pandemic, when China closed its borders, his restaurant became a gathering point for some of the 3,000 homesick Chinese workers building the Whoosh train who got stuck in Indonesia.

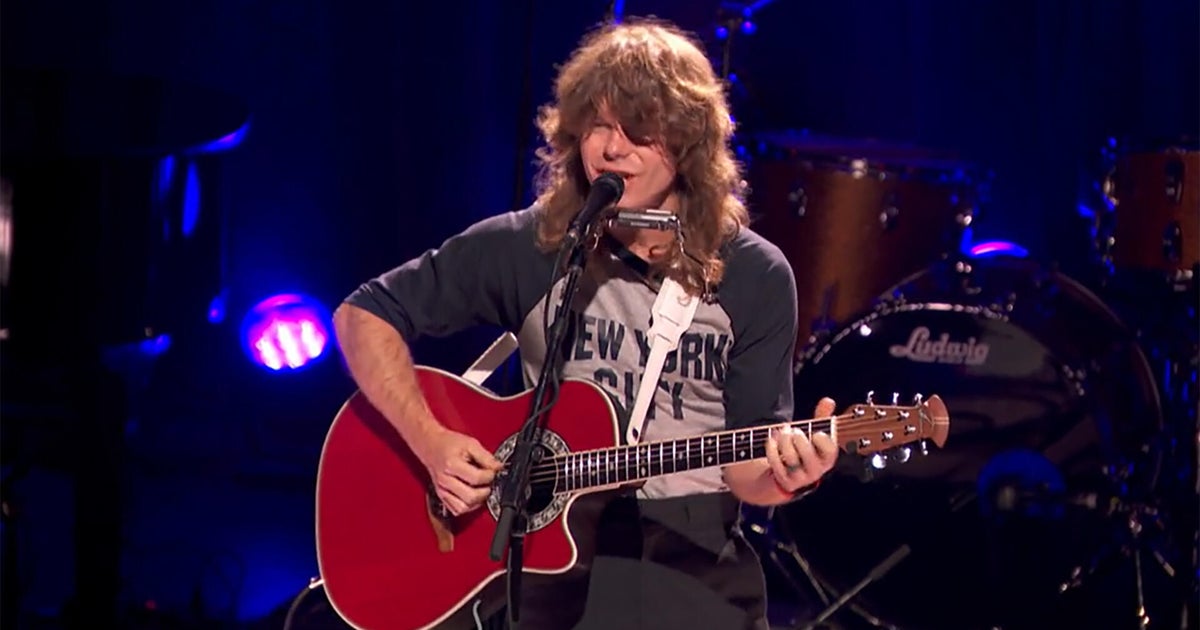

More than 200 miles east of Bandung, in the city of Solo, one of the country’s biggest textile factories shuttered in March, sending shock waves through the economy.

It is still reverberating across Java, Indonesia’s most populous and commercially vibrant island. The factory, owned by Sritex, attracted nearby workers and helped many families send their children to school before it collapsed under its debts, putting 10,000 people out of a job.

Tumi, 53, started working in the factory’s yarn spinning department 30 years ago. She met her husband there.

Standing in her living room, where photos of her colleagues are interspersed with family portraits, she gestured. “This was all built with my salary from Sritex,” said Ms. Tumi, who like many Indonesians goes by one name.

She and her friend Sri Lestari, who worked at Sritex for 24 years, teared up when talking about the day in February when management told all the workers that they could go home for the last time.

Both women are unsure how to keep paying for tuition for their children still in school. They are making ends meet by operating spicy chicken and coconut stalls outside Ms. Tumi’s house. But the money is not nearly enough.

-3.png)