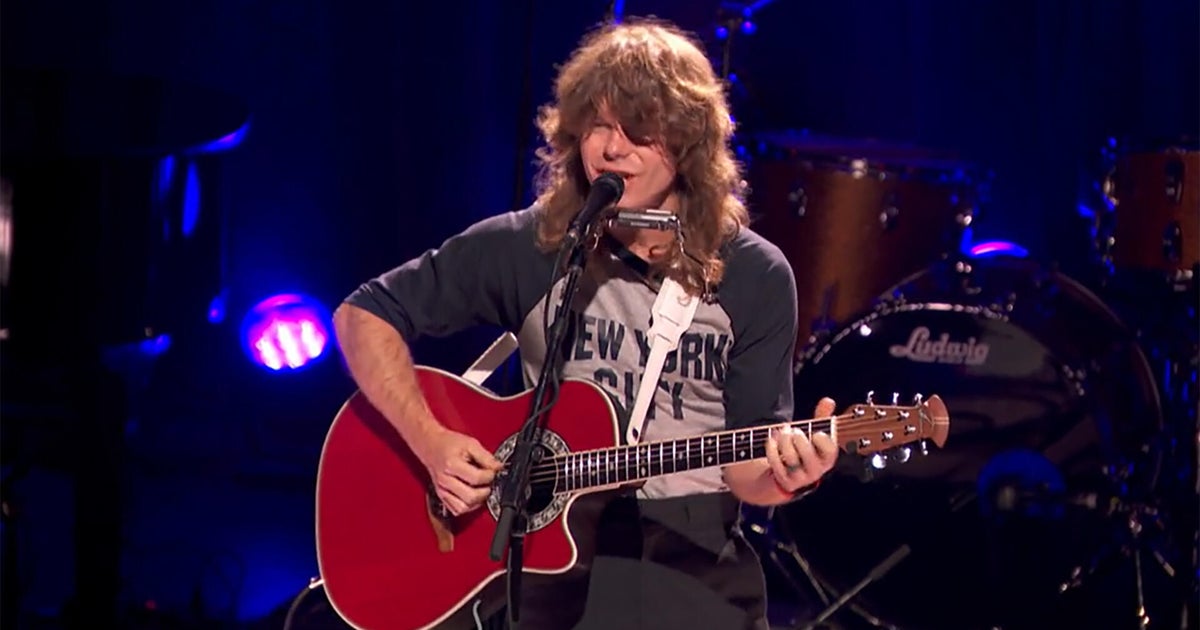

Five years ago, Sian-Pierre Regis, then 35, welcomed new roommates to his Manhattan apartment: his mother, Rebecca Danigelis, 78, and his partner, Sam Moll, 30, whom he had been dating for two years. “It sounds like a sitcom — two gay men and a mom in a cramped New York rental,” Mr. Regis said. “It felt like this quirky experiment.”

They made the most of their tight quarters, constructing gingerbread houses together at Christmas and sharing “highs and lows” every Friday at the dinner table. But for Ms. Danigelis, encountering her son’s dirty dishes in the sink and sleeping in a windowless spare room was not exactly how she had envisioned her golden years.

Instead, the arrangement was born of necessity after she was laid off from her longtime job as a hotel housekeeper in Boston and could no longer afford her rent.

“I never in the world expected to be in that position,” she said. “I’d worked my tail off my whole life.”

At the time, Mr. Regis didn’t know anyone else in his shoes, either. “None of my friends had parents living with them,” he said. That changed after he and his mother shared their experience in a New York Times article about young adults who were financially supporting their parents, published in May 2020.

In the years since, those young adults have found solidarity with others in the same boat — people in their 20s, 30s and 40s who help their parents with money, housing or both. As Mr. Regis said, “It opened up conversations with peers that made me realize I was much less alone in my responsibilities than I thought.”

He’ll have even more company soon, especially if the economy tightens and social services diminish. A 2024 survey conducted by the AARP found that 20 percent of respondents over 50 had no retirement savings at all, and more than half said they would not be able to support themselves when they could no longer work. Their adult children may be needed to fill in the gaps, whether they know it yet or not.

Now, half a decade after the article’s publication, The Times followed up with those who participated in it to see how they are faring.

Showing up in unexpected ways

Mr. Regis, a filmmaker, didn’t just bring his mother under his roof — he integrated her into his professional life, too. He is creating a podcast, “Raising Adults,” about the experience of “being called to parent a parent,” as he puts it.

“Many of us are at a point where we need to show up for our parents in ways we didn’t anticipate,” he said.

America’s view of multigenerational living has shifted since the pandemic. Reporting on the topic was dominated by headlines about adults in their 20s and 30s moving back in with their parents, but the “reverse boomerang effect” — older parents moving in with their adult children — became more common, too.

In 2021, 15 percent of multigenerational households were headed by an adult between the ages of 25 and 34 who had a parent or older relative living with them, a marked increase from the previous year, according to reports from the Pew Research Center. Many of these arrangements were temporary, but they reflected a more consistent trend: Another Pew analysis found that older Americans were significantly more likely to live with their adult children in the past decade than they were in the 1990s.

Beyond housing their parents, many younger adults — particularly those now in their 30s and 40s — are providing physical and financial support, said Rodney Harrell, a vice president at the AARP Public Policy Institute.

“The number of millennials caring for an older family member is only going to keep increasing as our population ages,” Dr. Harrell added. Another AARP survey found that the majority of adults who cared for a parent incurred out-of-pocket costs to do so, in addition to contributing their own unpaid labor.

A visit becomes permanent

Older Americans’ lack of retirement savings may look like a slow-moving crisis, and for many families it will be. But for Dulcinea Myers-Newcomb, a real estate agent who is now 50, caring for her father until his death in 2023 was less of a financial burden than she had feared, especially once she gained access to state-run elder care services.

“I remember once seeing a news story about the ‘sandwich generation’ — people taking care of young kids and older parents at the same time — and thinking, ‘Well, that looks terrible,’ she recalled. “And then it happened to me, and now it’s happening to tons of people I know.”

Ms. Myers-Newcomb’s father arrived to visit her family in Portland, Ore., in 2017 with a couple of suitcases and announced that he would be staying indefinitely. His previous housing, a rental, had fallen through, and he didn’t have any savings; his income, limited to checks from Social Security and a public retirement fund, added up to about $700 monthly.

Ms. Meyers-Newcomb and her husband were raising their two children and still paying off their own student loans; they didn’t have money or space to spare.

“We had to think outside the box, literally, in terms of housing,” she said.

They took out a home equity line of credit and used it to build a small structure, known as an accessory dwelling unit, or A.D.U., in their backyard. Her father lived there until he moved to a memory-care facility shortly before his death. They recently started renting it to a tenant.

Managing her father’s health care, especially after he was diagnosed with Alzheimer’s disease in 2021, was challenging, Ms. Myers-Newcomb said.

At first she and her husband tried to care for her father themselves while working from home. “But then things got to the point where it took all our waking hours to make sure he had his medication, his meals, his showers, everything,” she said.

When it became clear that they needed professional help, she found a lawyer who helped her father qualify for Medicaid, which covered almost all of his care expenses, including a state-run program that offered in-home aides and, eventually, a facility with 24-hour supervision.

The legal fees added up to about $8,500, Ms. Myers-Newcomb said, but were well worth it.

“My father’s care would have been over $10,000 a month, but with the lawyer’s help, it ended up being $711 a month,” she said. “I feel so lucky that we were able to find the right people who could help us. Otherwise, I don’t know what we would have done.”

Now, many of her friends are coming to her with questions about their parents, and she is glad she can point them in the right direction.

“Ultimately, I’m so glad we were able to spend those years with my dad, and to raise my children in a home where we were caring for an elder,” she said. “I’m also happy to be a resource to others who are doing the same.”

Starting a ‘dad fund’

Uncertainty about future expenses — and when they might arise — is one of the biggest stressors for adults who know their parents are (or will be) financially reliant on them.

Athena Valentine Lent, a freelance writer and author of “Budgeting for Dummies,” started a “dad fund” more than five years ago; today, she’s a few hundred dollars short of her $5,000 goal. Meanwhile, her father, who is almost 60, has had two strokes and retired from his job at Walmart with very little savings, she said.

He lives with his girlfriend and does not require Ms. Lent’s financial help — yet. “But I am prepared for that to change at any time,” she said. “It could be five years from now, or it could be tomorrow. I’ve prepped my fiancé that my dad might just show up with a dog and some boxes and never leave.”

Ms. Lent, 39, lives in Phoenix, about a three-hour drive from her father. “If he called and said, ‘I need you,’ I could hop in my car and be right there,” she said. She chose a ranch-style home in case he moves in on short notice.

“I know stairs would be a problem for him, and our place has a den that we could convert into his room,” she said.

She and her fiancé were planning a wedding last year, but decided to cancel it; they may elope instead. “We figured it would be better to have a financial cushion than a ceremony,” she said.

Despite — or perhaps because of — all the effort that she puts into planning for her father, Ms. Lent describes their relationship as “complicated.” She worries that he isn’t managing his diabetes or taking his medication regularly, and he doesn’t seem to take her concerns seriously — a point of contention between them, especially since she will have to manage the consequences. “In my community, as a Latina daughter, I’m expected to take care of him,” she said.

One way she copes with the anxiety of knowing he will be her responsibility someday is therapy. “I always tell other people in my position to get a good therapist,” Ms. Lent said. “It can be very taboo with people of color, and that’s why I am very open about it.”

Money ‘wasn’t the main point’

Even though the decline of a parent is hard to think about, it needs to be part of everyone’s financial plan, said Georgia Lee Hussey, a certified financial planner in Portland.

“These days, the majority of my clients have a parent calculated into their finances in some way or another, and I always ask about it whenever I’m working with someone new,” she said.

Most clients are relieved when she brings it up. “It used to be that most middle-class or wealthy families didn’t have to worry about their older relatives, whereas now it’s becoming more of a widespread concern,” she said. “As social safety nets like Social Security, SNAP benefits, and Medicaid and Medicare are under threat, the elderly are much more vulnerable, whether they’re aware of it — or will admit it — or not.”

No matter what her clients’ situation might be, Ms. Hussey encourages them to suss out their parents’ retirement plans.

“If it seems your parents might be resistant to the topic, I’m a big fan of making up a ‘friend’ who’s having a hard time, and using that as a way in,” she said. “Like: ‘I have a friend whose parents weren’t able to find the supportive housing they needed, and I saw how hard it was for the whole family. I want to make sure we avoid that. Should we research your options?’”

Best-case scenario, your parents could be better off than you think. Ka Po Lam, a treasury analyst at a bank in New York, has contributed to his family’s finances since he worked at McDonald’s as a teenager. When he was in his early 20s, he was expected to send home $800 a month — a significant chunk of his entry-level Wall Street paycheck. But he didn’t question it; if anything, it was meaningful that his family could count on him.

A few months ago, Mr. Lam, 33, traveled with his family back to Hong Kong, where he was born. “When my parents were around their old friends, they spoke more candidly than they normally do around me and my siblings,” he said.

Hearing their conversations made him realize that his financial contributions may have had more to do with his parents’ principles than their needs.

“I learned that the money wasn’t the main point,” he said. “It was more about building a habit where I don’t spend all my money — I had to save it, set it aside, live below my means. It’s clear to me now that my parents have been saving their whole lives. I’d obviously be willing to jump in and help more if they needed it, but I don’t think they do.”

His paycheck is bigger now than it was at the beginning of his career, so sending money home to his parents is less of a hardship. “As my salary has increased, I’ve also saved more,” he said. “Looking back on what my parents did, I appreciate it a lot now. I might implement a similar strategy if I have children of my own.”

Paying for two apartments

Mr. Regis, now 40, says caring for his mother has had unexpected benefits. He and Ms. Danigelis, now 84, have joined forces to become activists, speaking together at schools and working with politicians to combat ageist hiring policies.

More recently, they’ve become neighbors instead of roommates. After Mr. Regis’s landlord in Manhattan raised the rent, it became more affordable for them to find separate apartments in Brooklyn.

“My mom was like, ‘I really appreciate everything you’ve done for me, but I would really like to have a room with a window,’” Mr. Regis said with a laugh.

He and Mr. Moll now pay $2,650 a month for their own place in Bedford-Stuyvesant, and Mr. Regis pays $3,100 a month for Ms. Danigelis to live a few blocks away in Clinton Hill in a studio apartment with a doorman — and a nice big window.

“I felt guilty at first, with her living by herself,” Mr. Regis said. “But I also wanted to take care of my relationship with my partner.”

Having more space has been good for everyone, he added; Mr. Moll recently brought Ms. Danigelis lunch and took her to get her nails done. It’s not easy to afford two leases, though. When they moved, Mr. Regis had to borrow money from a friend to pay the two security deposits and first month’s rent for both places, which he has since paid back.

“I haven’t been able to save much overall, and I do wish I had more security,” he said. “But I do have a lot of faith in my community to show up for me when I’m in need.”

That time may be approaching. Ms. Danigelis was diagnosed with cancer a few months ago and has started chemotherapy; Mr. Regis visits her for at least two hours every day, accompanies her to all her doctor’s appointments and takes her to her treatments every Wednesday.

But her medical bills are another matter. He estimates that she owes more than $10,000, even after Medicare coverage. He isn’t sure what they’re going to do long term, especially since her Social Security benefits make her ineligible for Medicaid.

“We’re going to look into payment plans when we need to,” Mr. Regis said. “I haven’t co-signed anything. My job, first and foremost, is to keep her safe and comfortable.”

His efforts aren’t lost on Ms. Danigelis. “I can’t repay him for what he’s doing for me,” she said. “But I love him and I appreciate him, and I’m proud of him and I’m grateful to him. So I tell him that every chance I can get.”

-3.png)