Martin Lewis says motorists who were mis-sold car finance are likely to receive "hundreds, not thousands of pounds" - with regulators launching a consultation on a new compensation scheme.

The founder of MoneySavingExpert.com believes it is "very likely" that about 40% of Britons who entered personal contact purchase or hire purchase agreements between 2007 and 2021 will be eligible for payouts.

"Discretionary commission arrangements" saw brokers and dealers charge higher levels of interest so they could receive more commission, without telling consumers.

However, an industry body representing lenders has questioned whether a compensation scheme of such scale is even possible. Shares in companies exposed to potential payouts rose sharply on Monday morning.

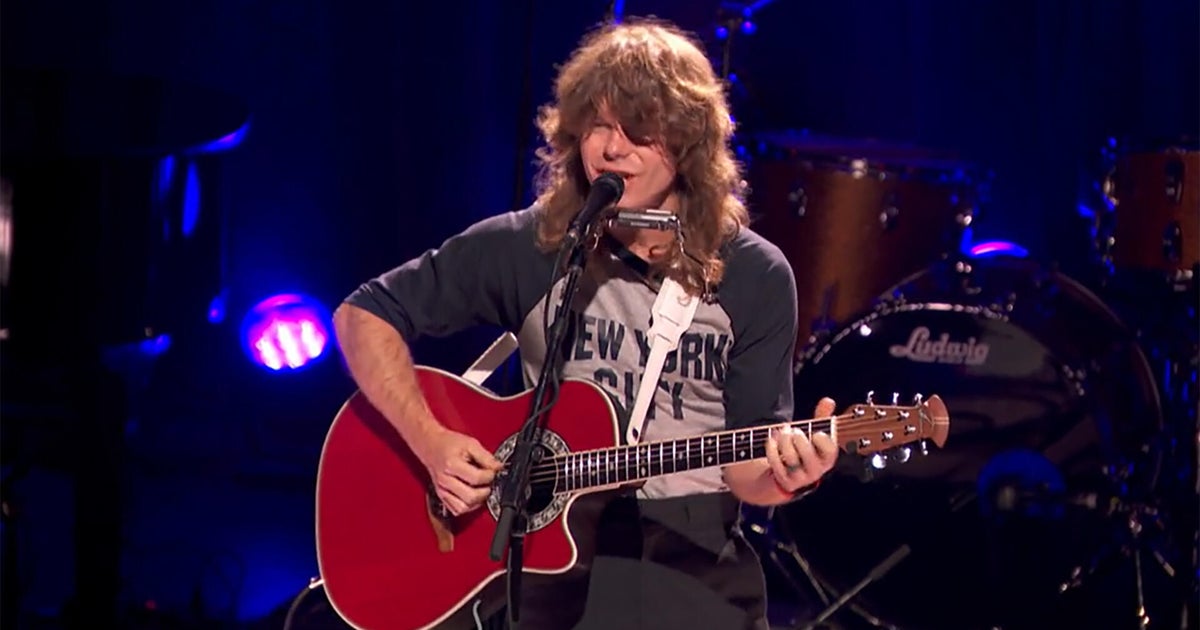

Speaking to Sky News Radio's Faye Rowlands, Lewis expressed confidence in the prospects for compensation.

He said: "Very rarely will it be thousands of pounds unless you have more than one car finance deal.

"So up to about a maximum of £950 per car finance deal where you are due compensation."

Lewis explained that consumers who believe they may have been affected should check whether they had a discretionary commission arrangement by writing to their car finance company.

However, the personal finance guru warned against using a claims firm.

"They're hardly going to do anything for you and you might get the money paid to you automatically anyway, in which case you're giving them 30% for nothing," he added.

Read more: How to tell if you've been mis-sold car finance

Yesterday, the Financial Conduct Authority said its review of the past use of motor finance "has shown that many firms were not complying with the law or our disclosure rules that were in force when they sold loans to consumers".

The FCA's statement added that those affected "should be appropriately compensated in an orderly, consistent and efficient way".

Lewis told Sky News that the consultation will launch in October - and will take six weeks.

"We expect payouts to come in 2026, assuming this will happen and it's very likely to happen," he said.

"As for exactly how will work, it hasn't decided yet. Firms will have to contact people, although there is an issue about them having destroyed some of the data for older claims."

He believes claims will either be paid automatically - or affected consumers will need to opt in and apply to get compensation back.

Read more from Sky News:

Hamas 'ready' to deliver aid to hostages

Oasis 'saddened' after man dies at concert

The FCA estimates the cost of any scheme - including compensation and administrative costs - to be between £9bn and £18bn.

Stephen Haddrill, director general of the industry body the Finance and Leasing Association, said: "We have concerns about whether it is possible to have a fair redress scheme that goes back to 2007 when firms have not been required to hold such dated information, and the evidence base will be patchy at best.

"We will be interested to see how the FCA addresses this point in its consultation."

The regulator's announcement came after the Supreme Court ruled on a separate, but similar, case on Friday.

Lloyds, the UK listed bank most exposed to the motor finance issue, has previously set aside £1.2bn to cover any compensation.

It said on Monday: "After initial assessment of the Supreme Court judgment, and pending resolution of the outstanding uncertainties, in particular the FCA redress scheme, the Group currently believes that if there is any change to the provision it is unlikely to be material in the context of the Group.

"The provision will continue to be reviewed for any further information that becomes available, with an update provided as and when necessary."

Its shares rose by more than 7% in response, leaving them on course for their best one day performance since 2022.

Those in Close Brothers - another lender - were up by more than 25%.

-3.png)