An insomnia diagnosis yielded a recommendation for a five-pack of beef hot dogs. An acne diagnosis brought a medical note proposing that the condition be treated with classes at a mixed-martial-arts gym. Decades-old arm fractures earned a nurse practitioner’s order to buy a kettlebell from Nike.

And because a medical provider had blessed the purchases, they came with the promise of a major perk: People could buy them using money not subject to federal income taxes.

That is the daring new world of American medical spending that Truemed, a three-year-old wellness company, is trying to build. Its co-founder Calley Means has rocketed to the upper reaches of power in the health care system as the right hand to Health Secretary Robert F. Kennedy Jr.

Operating in a little-known corner of the nearly $5 trillion health care system, Truemed helps supply people with letters attesting to their medical need for products like red-light masks, Peloton bikes and $9,000 saunas. With those letters, the company tells people, they can use health savings or flexible spending accounts to buy the items. The accounts allow people to set aside a limited portion of their income, without paying federal income tax, for qualified medical expenses.

Buying this way can save some people thousands of dollars.

But tactics like Truemed’s challenge core principles of the Internal Revenue Service guidelines around medical expenses, former regulators said in interviews. In justifying certain purchases, the company has facilitated letters that misapplied medical studies to patients. And Truemed enlists online medical providers who, The New York Times found, sometimes sign letters within seconds of users’ requesting them — even when the letters contain incorrect or extraneous information.

Despite an alert from the I.R.S. last year about its business model, the company now stands poised to benefit from changes to the health care system being pursued by the Make America Healthy Again movement and its Trump administration backers. That includes provisions in President Trump’s sweeping new domestic policy bill that will expand access to health savings accounts, broadening Truemed’s pool of potential customers.

Asked about Mr. Means’s roles at Truemed and in the Trump administration, Harrison Fields, a White House spokesman, said, “All administration officials will comply with conflict of interest requirements.” Mr. Means has said previously that his government work did not touch on issues affecting Truemed.

In a statement, Truemed said that it “implemented a compliant, industry standard telehealth process in early 2024, in part to address feedback from the I.R.S.” Its medical evaluation process was as robust as that of companies selling prescription drugs online, despite Truemed’s offerings presenting “no risk of dangerous side effects,” the company said.

“There is no valid basis upon which to single out and criticize our approach to telehealth, when in fact, it is the same compliant process followed by reputable telehealth providers and used by millions of people across the country to better their health,” Truemed said. It said it was helping to “reduce the bureaucratic red tape” that discouraged tax-advantaged purchases “on clinically supported and cost-effective alternative preventive measures and interventions.”

To understand Truemed’s process — and the MAHA-friendly model of medical spending it represents — reporters from The Times interviewed users of the service and made purchases themselves across many of Truemed’s categories, including sleep, supplements, fitness equipment and gym memberships. Without a letter of medical necessity, many of the purchases would not have been eligible for spending from tax-privileged accounts.

The reporters made those purchases to treat or prevent their own diagnosed medical conditions.

A foot injury from years earlier earned a letter of medical necessity for a stand-alone pool for cold plunges. The insomnia diagnosis led to letters suggesting the condition be ameliorated with products like an alarm clock, headphones and ground beef.

When a reporter tried buying a water filter, Truemed asked if he had any of a number of diagnoses, including “mitigation of contact with water pollution.” The reporter clicked it, wanting to mitigate contact with water pollution, and soon received a letter listing the same phrase as his “medical condition.”

Truemed also rejected some of the reporters’ qualification requests, including for letters backing purchases of PlantStrong Foods products and a climbing gym membership.

Truemed, whose other co-founder, Justin Mares, also started companies selling supplements and bone broth, typically earns fees from its product vendor partners. The company said it had facilitated roughly 500,000 letters last year.

As a special government employee in the Trump administration, Mr. Means has criticized widespread prescription drug use while promoting preventive measures, like exercise and nutritious food, that can be purchased through Truemed.

He and his allies have risen to power by railing against corporate interests profiting from America’s health care system. But his company offers a window into how MAHA emissaries, too, stand to gain from the new system they are trying to build in its place.

That new system is one that economists said would benefit wealthier Americans, who have more to gain from diverting money into tax-privileged accounts, while poorer people could lose access to publicly funded health insurance.

“It’s a tax break for upper-middle-class people,” said Sherry Glied, an economist and the dean of the Wagner School of Public Service at New York University. “Sicker people and poorer people are going to have to pay more so richer people and healthier people will pay less.”

Rubber Stamps, Raised Questions

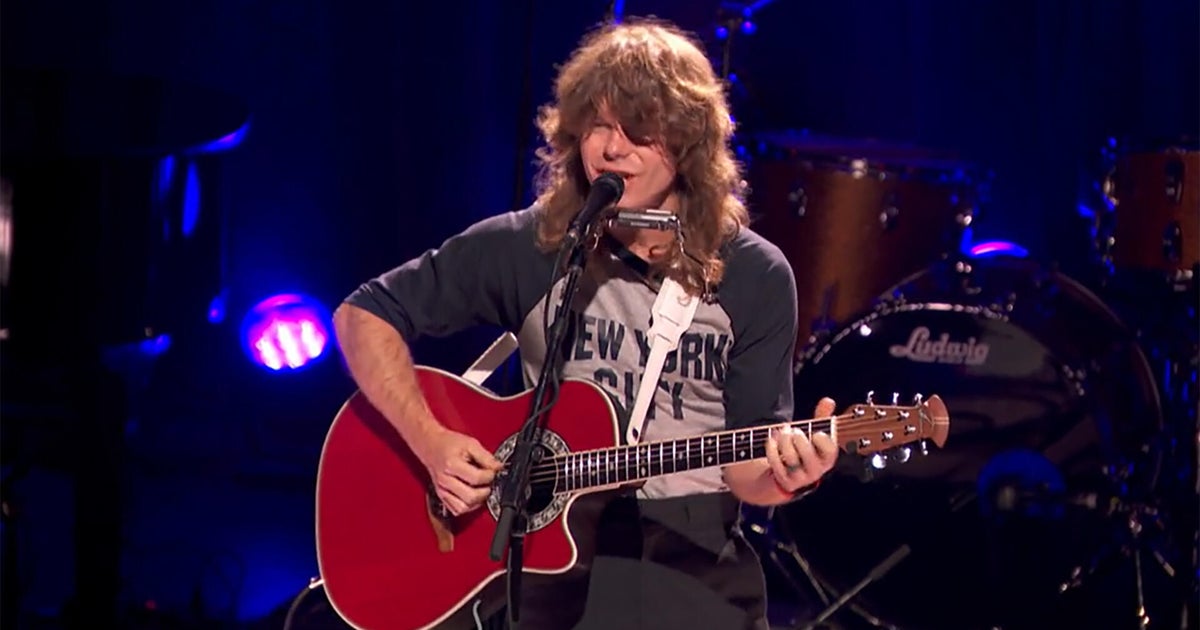

James Popp wanted a home exercise bike. And not just any bike: a Zwift, an $800 machine that would let him climb the French Alps virtually from his basement in Michigan. “Zwift is a thing,” said Mr. Popp, a 44-year-old corporate executive, “that middle-aged men buy when they have too much time.”

If he paid with a tax-advantaged account through Truemed, Zwift promised in a marketing email in December, he could save roughly 30 percent.

Mr. Popp would never have to speak or even text with a medical provider nor supply medical records. Instead, the Zwift order page would take him to Truemed’s brief online questionnaire, which came populated with possible answers. “Have you been diagnosed with any of the following conditions?” it asked. “Do you have a family history of any of the following conditions?”

The questionnaire does not ask directly about the timing of diagnoses. It asks that users attest to making the “purchase primarily for the purpose of curing, mitigating, treating, or preventing the diagnosed medical condition(s).” In small type, the payment page also links to Truemed’s terms of service, which require users to provide “current and complete information.”

Mr. Popp gathered that Truemed was likely to deem him eligible for a tax-favored purchase if he clicked one of the suggested conditions. And he did, in fact, remember his grandparents having heart problems. So he reported a family history of heart disease.

“It’s pretty easy for a knowing consumer to understand what information they’re looking for,” Mr. Popp said. “It feels a little bit like a giant wink.”

Within minutes and without a meeting, a nurse practitioner at a telehealth company signed a letter saying he needed the Zwift for “prevention of heart disease” — a letter that Truemed told him qualified him to buy the bike with a tax-privileged account. The language in the letter seemed calibrated to meet the I.R.S.’s definition of a medical expense: costs undertaken “primarily to alleviate or prevent a physical or mental disability or illness.”

Mr. Popp said: “I don’t know if I can say I wanted this for real health reasons. I’m a middle-aged man who likes buying toys for himself that get him to exercise.”

By the time Mr. Popp bought his bike, the I.R.S. had tried to clamp down on practices like Truemed’s. In March 2024, under President Joseph R. Biden Jr., the agency issued a pointed alert declaring that “personal expenses for general health and wellness are not considered medical expenses under the tax law.”

The I.R.S. added: “Some companies mistakenly claim that notes from doctors based merely on self-reported health information can convert nonmedical food, wellness and exercise expenses into medical expenses, but this documentation actually doesn’t.”

Truemed boasted on Instagram in November that “the I.R.S. doesn’t like us” for helping people use tax-privileged accounts. That same day, Mr. Means wrote online that “almost everyone” was “preventing/reversing a chronic condition,” and should therefore demand letters endorsing tax-favored exercise and food purchases.

Food had been a particular concern of regulators. After all, if people could legally buy groceries using money from a flexible spending or health savings account, many millions of dollars would stop going to the U.S. Treasury.

In an F.A.Q. the I.R.S. published alongside last year’s alert, it said food and beverages were eligible expenses only if the food exceeds “normal” nutritional needs, “alleviates or treats an illness” and addresses a need “substantiated” by a physician.

In May, a food vendor, Force of Nature, announced a new partnership with Truemed. Force of Nature’s website declares that “Meat is (officially) Medicine.”

Ron, one of the reporters on this article, got a letter through Truemed backing the purchase of Force of Nature meat with his health savings account after declaring that he was overweight. The next day, Truemed helped supply a medical letter allowing 16 packets of instant bone broth via a different company, Bare Bones.

The letter noted that the protein would “provide essential amino acids, promote satiety, and potentially enhance metabolic rates,” helping to address the overweight diagnosis, and suggested daily use for a year.

The I.R.S. has never accused Truemed of wrongdoing. In its statement, Truemed said that food (in excess of normal nutritional needs), like other expenses, could be paid for via a tax-favored account as long as it met the I.R.S. definition of a medical expense. Truemed said its telehealth process, which it changed after the I.R.S. alert, complied with medical practice laws in all 50 states.

“It is our understanding that the I.R.S. is not in the business of second-guessing the determination of a licensed clinician,” the company added.

An I.RS. spokesman pointed back to its alert and did not comment beyond that.

Benefits lawyers questioned whether the letters supplied by companies like Truemed did in fact prove that the desired products were alleviating or preventing illness.

“The doctor’s note alone doesn’t make something a medical expense,” said William Sweetnam Jr., a former benefits tax counsel at the U.S. Treasury who helped develop guidance for tax-advantaged health spending, referring in general to suppliers of medical necessity letters.

Citing last year’s I.R.S. guidance, he said, “They were concerned that the note was not really dealing with the person — that it was more of a generalized note, and it was attempting to make what is a personal or wellness expense into a medical expense.”

Upending the System

Behind every Truemed purchase is a medical provider — a critical if unseen cog in the system — who weighs the use of mattresses, smartwatches and meditation apps to address medical conditions.

Once someone answers Truemed’s brief questionnaire, a provider — often a nurse practitioner — receives an at least partly pre-written letter of medical necessity from Truemed. If the providers approve the request, they sign and return the note, typically without ever speaking to or messaging the customer.

But it is not clear whether or how closely the providers review the documents. They work remotely for an Iowa-based company contracted by Truemed called OpenLoop Health.

On five occasions, Times reporters received signed letters of medical necessity within a minute of completing a purchase.

That included a letter attesting to Benjamin’s need for a Crunch gym membership, which arrived after he checked “acne” on Truemed’s diagnostic questionnaire. The diagnosis was 20 years old, but he still wanted to prevent periodic breakouts, as the questionnaire asked him to confirm. And Truemed did not ask for further details. The signed letter said that working out “serves as a potent modulator of metabolic pathways” and that “a structured fitness regimen” was “medically necessary” to address acne.

On another occasion, a letter endorsed the purchase of a Nike kettlebell after Benjamin said he had been diagnosed with “fractures” and wanted to prevent their recurrence. Despite Truemed never asking about the nature of those fractures, the letter described his “medical condition” using a diagnostic code that referred to the lingering effects of skull and facial fractures. (He had twice broken an arm decades earlier.)

In one instance, when Ron got a letter allowing the purchase of protein powder because of high cholesterol, the note contained three paragraphs about a sleep supplement that he had not ordered. The nurse practitioner who signed the letter left the errant passage in it.

Truemed said that the errors in the kettlebell and protein powder letters stemmed from software bugs that it had fixed, and that it did not use artificial intelligence to craft its letters. “Truemed continuously updates its software and other business operations,” it said. In the case of the errant passage about a sleep supplement, Truemed said, “We regret that in this particular instance the clinician did not catch the error.”

The company also said that the Times reporters had been “providing false information about purported current conditions and the purposes of your intended purchases in violation of Truemed’s truth and accuracy requirements.”

On some occasions, the letters cited medical research to justify its recommendations. But the rationales sometimes strayed from the study’s findings.

A letter endorsing purchases of hot dogs and ground beef for Benjamin’s insomnia said that “nutrient-dense complete protein can help mitigate elements related to insomnia by improving sleep quality.” But the study it cited investigated protein intake and sleep only in people who were overweight or obese and trying to lose weight.

Having asked for his height and weight, Truemed was aware Benjamin did not meet those criteria. But the nurse practitioner signed the letter recommending protein-rich foods anyway. A later study by some of the same researchers found that protein intake had no effect on sleep quality. Truemed mentioned only the study that supported protein-rich diets.

“It is an extrapolation beyond the research,” Wayne Campbell, a nutrition scientist at Purdue and senior author of the studies, said of Truemed’s interpretation of his results.

Truemed said: “Whenever we receive legitimate feedback about our services, we work in good faith to respond. In this case, we have already addressed the issue and implemented an update to our service.”

States have various rules about what constitutes a valid provider-patient relationship and what standard of care medical professionals must meet.

Truemed’s terms of service put the onus on OpenLoop to make the correct clinical assessment. Truemed said in its statement that OpenLoop was “contractually required to ensure our compliance with applicable telehealth and state practice of medicine laws.”

OpenLoop did not respond to requests for comment.

Truemed said the medical providers signing the letters were licensed and “subject to clinical practice obligations that create strong incentives to care about the validity of each” letter. Those providers were “paid by the hour, regardless of the clinical decisions they make,” Truemed said, and had no financial incentive to sign off on requests.

While acknowledging that state guidelines were vague, telehealth experts said rudimentary questionnaires might not be sufficient for obtaining letters of medical necessity.

“Rubber-stamping medical necessity letters without reviewing records or engaging with the patient isn’t clinical care,” said Aaron Maguregui, a partner specializing in telehealth law at Foley & Lardner. “It’s box-checking dressed up as medicine.”

Gleeful Biohackers

Truemed’s playbook is not entirely new. In recent years, companies like Uber and Airbnb have inserted themselves into legal and regulatory gray areas around zoning, licensing and insurance. In doing so, they turned established industries upside down and enriched their investors and founders.

Truemed already stands to benefit from Mr. Trump’s new law, the One Big Beautiful Bill Act, which could help millions of additional Americans become eligible for health savings accounts. Mr. Kennedy last year proposed an even more sweeping expansion, arguing that every American be given an account.

Mr. Means has in the past called for steering medical spending away from federal health care programs, like Medicare and Medicaid, and into the sort of tax-favored accounts that enable discounted purchases through Truemed.

Lawmakers have long sought to expand such provisions. They laid the groundwork for flexible spending accounts in 1978 and then, in 2003, created health savings accounts to prod Americans with certain insurance plans to be more cost-conscious about their medical care. This year, the most someone can set aside in a flexible spending account is $3,300, while annual contributions to health savings accounts max out at $8,550 for families. H.S.A. balances can grow much higher over time.

Health savings accounts no longer promote savings, economists have found. And spending from the tax-advantaged accounts pulls revenue away from the federal government, potentially at the expense of programs to treat the sick.

But it is not clear who would complain about Truemed’s practices. Gleeful biohackers and system beaters have spread the word on forums like Reddit about the Pelotons and Sleep Number mattresses that Truemed promotes.

Truemed said that “no regulatory agency has ever accused us of wrongdoing or any failure to comply with any state practice of medicine laws.”

Employers could, in theory, declare themselves unwilling to cover certain items in the flexible spending accounts they offer to workers. An I.R.S. examination that found problems with an employer’s plan could potentially invalidate every expenditure within it, leaving large numbers of employees who used their accounts for straightforward items, like ibuprofen, on the hook for taxes.

But in practice, the administrators that employers hire to run an F.S.A. program would be the ones to raise red flags. And those administrators are in a bind.

“They hate to tell people, ‘No,’” said Mr. Sweetnam, the former Treasury official, who now advises administrators as the legislative and technical director at the Employers Council on Flexible Compensation. “But they also want to run their plans correctly.”

In June last year, one administrator, Navia Benefit Solutions, told a Truemed user that it had stopped accepting the company’s letters of medical necessity. Navia pointed to Truemed’s terms, which it said described Truemed letters then as “general health guidance” that do not “create provider-patient relationship.”

But Navia changed course. Two months earlier, Truemed said, it had contracted with OpenLoop to “transition to a fully compliant telehealth process establishing a patient/provider relationship,” and then changed its terms accordingly. Truemed said that eliminated “outdated concerns” that administrators “may have had about our former approach.”

Last month, Truemed announced it was teaming up with Navia to offer “a seamless pathway to receive a letter of medical necessity.” Navia and Truemed said no money changed hands in creating the partnership.

Navia and other administrators will be receiving more such letters soon enough. Truemed competitors, like Flex and Sika Health, are already emerging.

Christine Keller, who helped write I.R.S. guidance around medical expenses and benefits plans when she worked as a lawyer at the agency for six years, suggests caution for both employers and administrators.

“What the I.R.S. is saying,” said Ms. Keller, who is now executive principal at Groom Law Group, “is that you can’t skip the step where a doctor who you have a relationship with is evaluating you as an individual who may or may not have a disease or condition.”

Kirsten Noyes contributed research.

-3.png)